sales tax on clothing in buffalo ny

But pay 110. While dropping the county sales tax on clothing and footwear would save shoppers money it would cost the Village of Williamsville nearly 21000 in lost tax revenues.

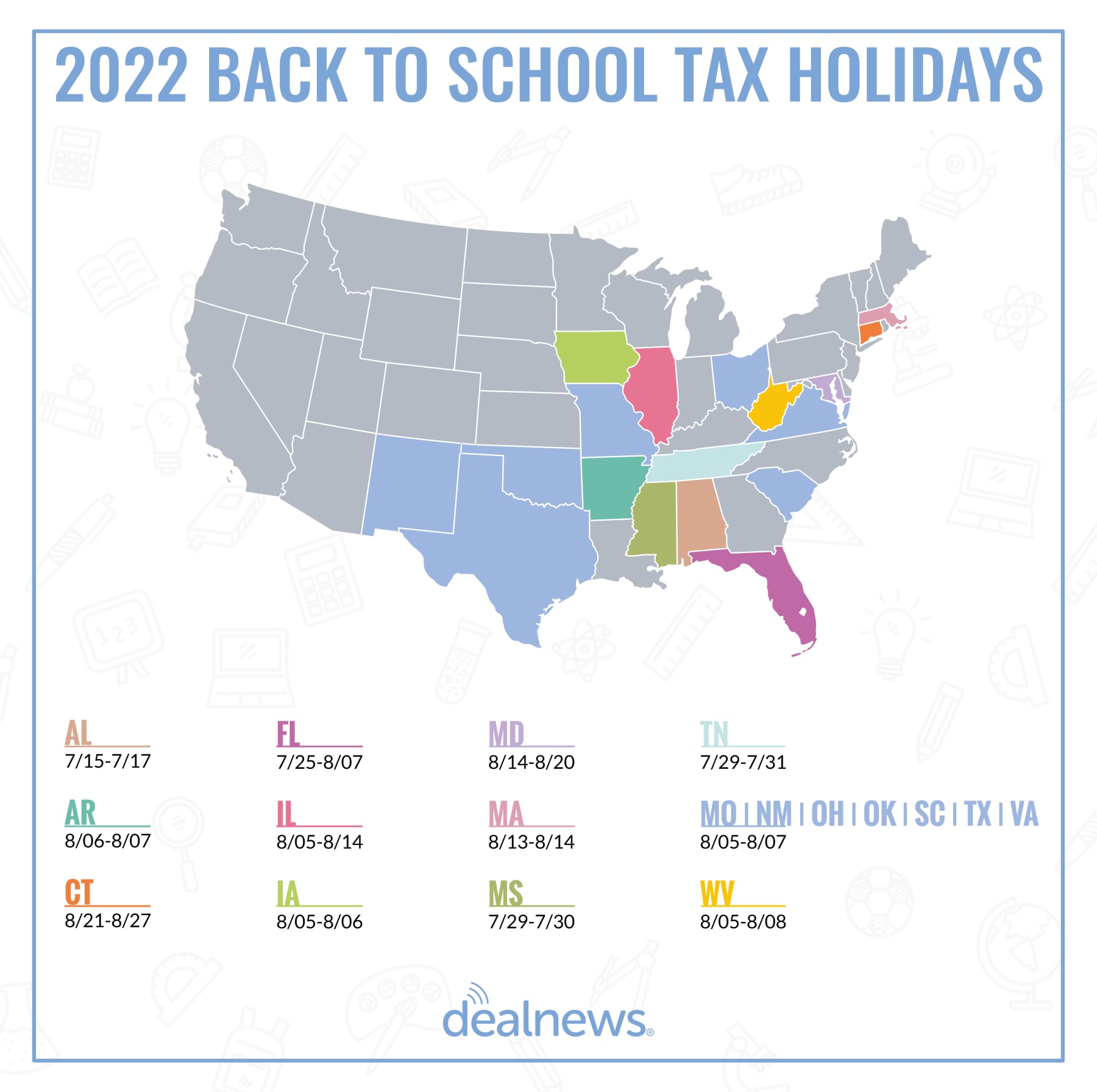

Tax Free 12 States Are Cutting Back To School Sales Tax This Weekend Marca

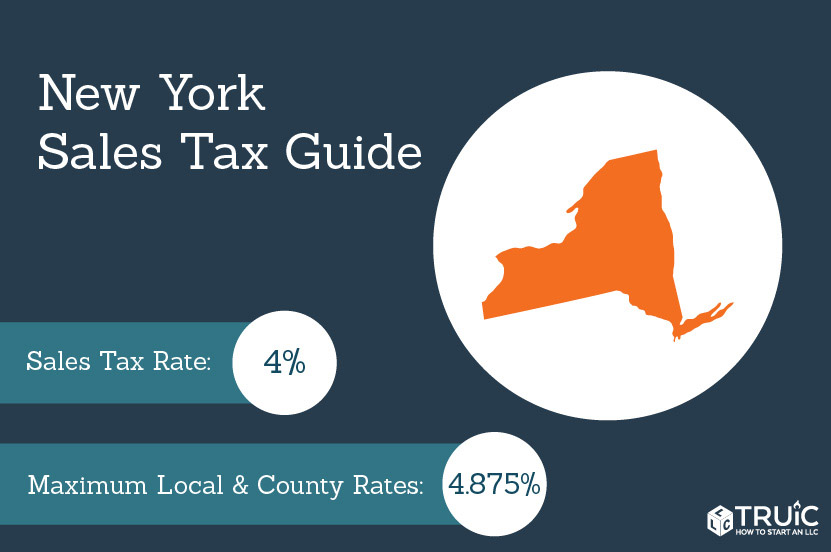

With local taxes the total sales tax rate is between 4000 and 8875.

. A change in the law this year Search Query. Thats the amount that triggers an extra 4 percent state sales tax charge on clothing and footwear purchases in New York. The minimum combined 2022 sales tax rate for Buffalo New York is.

Did South Dakota v. Beginning Sunday clothing and footwear priced under 110 will be exempt from. Buffalo NY Sales Tax Rate The current total local sales tax rate in Buffalo NY is 8750.

The 2018 United States Supreme. The Buffalo sales tax rate is. By Mark Scott Buffalo NY A sales tax-free week on clothing purchases in New York began Monday.

To help ease that shock Sen. Clothing footwear and items used to make or repair exempt clothing sold for less than 110 per item or pair are exempt from the New York State 4 sales tax the local tax in those localities. Second Sole ProprietorshipClothing in NY you will also need a sales tax ID to buy in bulk and sell in small amounts since you will need to charge and remit sales tax to the state of NY.

Borrello has introduced legislation that would raise the states 4 sales tax exemption on a single item from 110 to 250 on items such as winter. The New York sales tax rate is currently. The City Sales Tax rate is 45 NY State Sales and Use Tax is 4 and the Metropolitan Commuter Transportation District surcharge of 0375 for a total Sales and Use.

New York NY Sales Tax Rates by City The state sales tax rate in New York is 4000. The County sales tax rate is. Shoppers in New York State are getting back their clothing tax exemption on up to 110 per item.

This includes the rates on the state county city and special levels. The December 2020 total local sales tax rate was also 8750. 0125 lower than the maximum sales tax in NY The 875 sales tax rate in Buffalo consists of 4 New York state sales tax and 475 Erie County sales tax.

The sales tax rate in Buffalo New York is 875. Buy a coat for 10999 and youll avoid that extra 4 percent. Items that cost more.

Wayfair Inc affect New York. By Mark ScottBuffalo NY There will be no sales tax free week on clothing purchases for back-to-school shoppers this year. For a more detailed breakdown of rates please refer to our table below.

There is no applicable city tax or. While all forms of athletic apparel and protective gear and most accessories are taxable standard clothing and shoes are tax-exempt up to 175 per item.

How To Avoid New York Sales Taxes At The Mall Newyorkupstate Com

Sales Use Tax Hodgson Russ Llp

New York Resale Certificates For Businesses Legalzoom

When Is Your State S Tax Free Weekend In 2022

Tax Free Which State Will Suspend Sales Taxes This Week Marca

Tax Free Which States Are Suspending Sales Taxes This Week Marca

How To Avoid New York Sales Taxes At The Mall Newyorkupstate Com

When Is Your State S Tax Free Weekend In 2022

Amazon To Get 124m Tax Break To Build Niagara Warehouse Report

Buffalo Ny Print Buffalo Skyline Buffalo Ny Artwork Buffalo Etsy

New York Sales Tax Everything You Need To Know Smartasset

How To Avoid New York Sales Taxes At The Mall Newyorkupstate Com

The New York Clothing Sales Tax Exemption Demystified Taxjar

Should I Charge Sales Tax In My Online Boutique Start Your Boutique

State And Local Sales Tax Rates Sales Taxes Tax Foundation

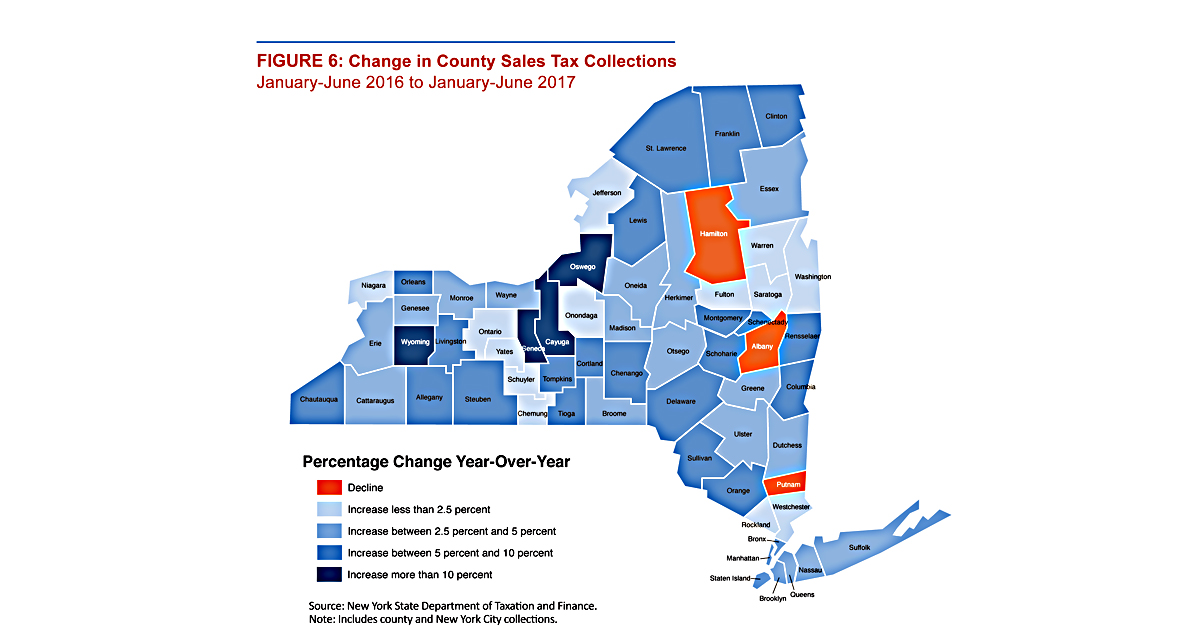

Cayuga County S Sales Tax Revenue Points To Growth Cayuga Economic Development Agency

New York Llc How To Start An Llc In New York In 12 Steps 2022

America S Best Window Comes To Buffalo Wonder Windows Buffalo Ny

_0.png)

Map State Sales Taxes And Clothing Exemptions Tax Foundation